Indian economy is experiencing significant growth on all fronts of business activities. Almost all industrial sectors are tracing a steady rise in revenue and are creating lucrative opportunities for foreign investments. Consequently, cross-border deals like M&A transactions are growing significantly in India.

Apart from economic growth, another significant factor that is shaping the improvement in cross-border M&A deals is the comprehensive assistance extended by top M&A firms in India.

With a detailed market analysis and insights into the ever-changing business dynamics, these consultancy firms are helping foreign investors in a diverse way. Such firms are helping investors in reducing investment risk and assuring long-term profitability. This has, in turn, made investing in consultancy firms in India hassle-free for foreign investors.

Advantages of Working With Top M&A Firms India

1. Frame out a Better Investment Plan

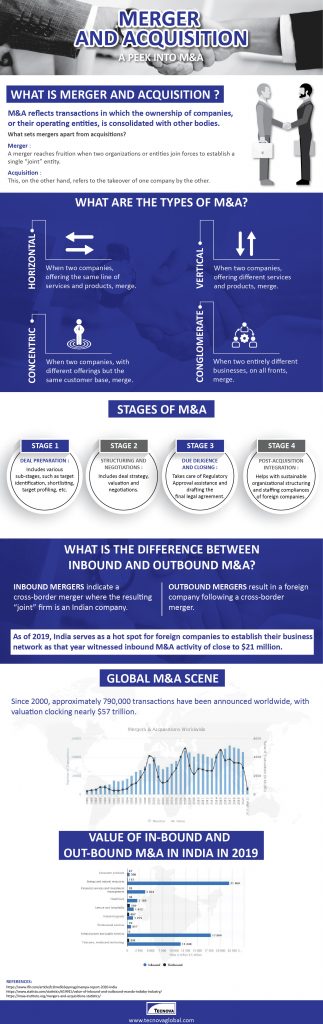

Merger and acquisition is the act of improving a company’s position in a competitive market by consolidating the assets of another firm. Though Mergers & Acquisitions are often considered similar, they are extensively different in application.

- Merger refers to a financial transaction in which two companies collaborate to join forces and begin to exist as a new entity.

- On the other hand, acquisition is an act of buying a majority or all the shares of a firm by another company such that it gets a complete hold over it.

Amidst the competitive business market in India, it is extremely crucial for foreign investors to choose the right cross-border deal.

A leading strategy management consulting firm India comes to be of great help in this regard. They offer end-to-end assistance in understanding the current market structure. They adequately help investors choose between mergers and acquisitions for profitable ROI in future.

2. Invest in the Right Type of M&A Deal

There are various types of M&A deals, namely:

- Horizontal- This M&A deal takes place between firms that have a similar supply chain and customer base.

- Vertical- Vertical M&A takes place between firms that have a similar customer base but different supply chains.

- Conglomerate- When two firms that belong to completely different industries with similar customer bases enter the M&A deal, it is known as conglomerate M&A.

- Concentric- Concentric M&A deals take place between firms that belong to different industries but have a different customer base.

Investing in top M&A firms in India will help foreign investors choose the right M&A deal type as per their long-term business objectives. This will further help them achieve a competitive edge in the dynamic market environment and ensure sustainable growth.

3. Execute the M&A Stages without Much Hassle

A leading strategy and management consulting firm India also helps foreign investors execute multiple stages of M&A activity conveniently. These firms offer comprehensive support in:

- Partner search and shortlisting target profile.

- Undertaking analysis and preparing deals as per reports.

- Initiate the negotiations and frame the final deal.

- Perform Due Diligence to ensure there are no discrepancies in the documents and reports submitted by the target firm.

- Comprehensive support in the post-deal integration process.

With such extensive assistance on all fronts of M&A activities, consultancy firms in India, like Tecnova, are proving highly advantageous for foreign investors. They are helping foreign investors to frame out India-specific M&A strategies with comprehensive market insights, thereby ensuring a better ROI.